Although MEME stocks plummeted collectively, American retail investors have already killed Wall Street?

The legendary investor and the prototype of the movie "Big Short", Michael Burry bluntly said in an interview with the media last month: "(MEME stocks) will collapse like the Internet bubble and the subprime mortgage crisis." Although the market is always reluctant to hear Michael Burry He made empty remarks, but in the end he was forced to find out that he was right.

The legendary investor and the prototype of the movie "Big Short", Michael Burry bluntly said in an interview with the media last month: "(MEME stocks) will collapse like the Internet bubble and the subprime mortgage crisis." Although the market is always reluctant to hear Michael Burry He made empty remarks, but in the end he was forced to find out that he was right.

It seems that only overnight, while the U.S. stock market is still continuing to hit new highs, Wall Street's hottest MEME stock has entered an era of total shrinkage in which both volume and price fell.

The so-called MEME stocks refer to a series of stocks that are not based on performance, such as AMC cinemas, game stations, and BlackBerry, which are suddenly "passionate" bets by retail investors. These companies may be new companies or established companies, growth stocks, or blue chip stocks, and their market value may be undervalued or overvalued. Their common feature is that retail investors have launched a wave of hype about these stocks on social media.

Due to the ebb of risk sentiment and the decline of retail investor preferences, these "net red stocks" that have broken countless records are currently being harshly and ruthlessly abandoned by Wall Street. According to the market data of Investing.com, in the last month, AMC Cinemas (NYSE:AMC) fell 35.35%, Game Station (NYSE:GME) fell about 25%, and BlackBerry (NYSE:BB) fell 15.18 %, Clover Health Investments Corp (NASDAQ:CLOV) also fell more than 30%. When you buy MEME stocks, you should realize that these stocks that have soared overnight without fundamental support will also "collapse" overnight.

Among them, Game Station is arguably the most well-known MEME stock on Wall Street and the most volatile stock in this market. In the past week, the stock has fallen by 9.68%. Within a month, the stock soared from $17 to a peak of $483, and has now fallen to $152.75. However, since the beginning of this year, the stock is still up 710.77%. Earlier, Netflix announced that it would enter the video game business, which also led to a further decline in the game station.

At the same time, AMC Cinemas is still the best-performing stock in the MEME concept stock this year, with its stock price soaring nearly 1500%, almost twice that of Game Station. Although the decline in the past month reached 35.35%, but this year, the stock has still risen more than 1484%. However, recently, due to the surge of new crown cases in the United States, stocks benefiting from the economic restart are under pressure. The share price of AMC theaters has fallen by 13.65% in the past week.

MEME stocks have their ups and downs, but some new investment “postures” are quietly popular-not to mention whether MEME stocks will rebound from this round of plunge, after the carnival, the pattern of the investment market has been changed forever .

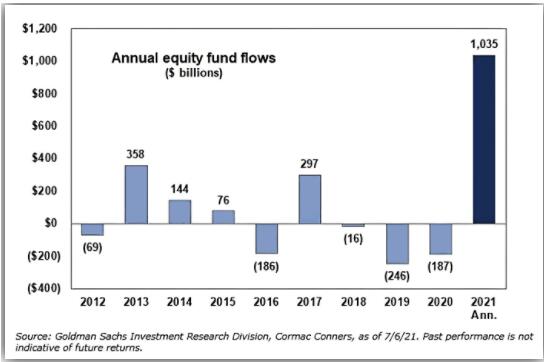

With a large number of retail investors using social media, Robinhood and other applications to make large-scale investments, the WallStreetBets forum on Reddit has more than 10.7 million members. Moreover, if you think that this large number of US retail investors are only temporary interests or "boring pastimes" during the epidemic, you are quite wrong. A survey by the robo-advisory platform Betterment shows that 58% of day traders Say they plan to conduct more transactions in the future, and only 12% plan to reduce transactions.

While MEME stocks hit record highs, Wall Street hedge funds have also suffered billions of dollars in losses. Changes in the pattern of the investment market have had a huge impact on the entire hedge fund industry. It seems that retail investors will not be "killed" like before. In 2021, retail trading volume will account for 24% of the total stock trading volume, up from 15% in 2019, through the WallStreetBets forum on Reddit, Twitter and other social media , They will unite and exert influence on Wall Street institutions.

If you think that MEME stocks are just a "joking" and meaningless discussion, then you may suffer. Obviously, Wall Street investment banking institutions and listed company executives value the opinions of retail investors on the WallStreetBets forum. A survey by Bank of America shows that about 25% of institutions are already tracking investor sentiment on social media. , About 40% of institutions expressed interest in doing the same in the future. And the executives of the AMC cinema chain even cancelled this decision because "the issuance of new shares was opposed by forum users."

In short, MEME stocks fluctuate tremendously, and the rise and fall is amazing. For investors, the investment risk involved is quite large. However, you can't help but study the logic of the group of WallStreetBets retail investors behind MEME stocks, because they have already Stepped onto the big stage of Wall Street.