A terrible sign: "retailization" of hedge funds

Hedge funds have always been regarded as one of the most professional investment groups in the market, so their management costs are much higher than those of ordinary actively managed funds or index genes. However, in the past two years, retail investors are best at "chasing the rise and killing the fall" began to spread. To hedge funds.

Retail investors are afraid of missing the market, so they like to start chasing after a sharp rise. From the statistical data, now American retail investors are all using leverage, options, and all in. However, what is terrible is that this "wind deviation" has also infected hedge fund managers, who are now "going all out."

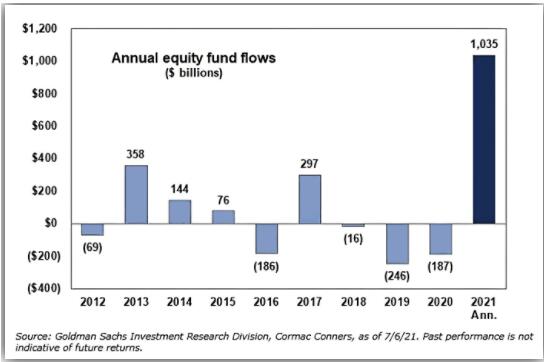

According to statistics, after the 2008 financial crisis, the net inflow of equity funds in the first half of this year hit a record high. Specifically, a large part of this capital comes from investors outside the United States, because their confidence in the recovery of the US economy and the performance of the US stock market in recent years have made them bet heavily.

Considering the Fed’s monthly QE scale of 120 billion U.S. dollars, it’s no surprise to chase the rise!

The well-known fund manager John Hussman explained the impact of QE early on:

"The biggest impact of quantitative easing on the market is psychological factors. As long as investors tend to speculate, they will regard zero-interest cash as inferior assets, so they will chase any assets that may generate high returns. Not important, because investors have already ruled out the possibility of asset prices falling in their hearts."

In other words, what QE conveys is not financial information but a kind of psychological comfort, so the only factor that changes the effectiveness of the Fed's monetary policy is in the hearts of investors.

Faced with performance pressure, professional managers have to join this asset carnival. According to monitoring data, the leverage ratio of hedge funds is now the highest in history. However, their performance has forced them to chase high again and again. According to the Wall Street Journal, Morgan Stanley and Goldman Sachs client reports show that in the first half of this year, fund managers who choose stocks based on fundamentals have a negative value. This year the US stock market has rapidly switched between value and growth, which makes it difficult for fund managers to find a balance.

The current hedge fund equity net long exposure is 40%. Since 2003, when the net long exposure is below zero, the S&P 500 has an annualized return of 15.2%, and when it is above 25%, the S&P 500’s return is only 1.4%.

The U.S. stock market has not experienced a correction of more than 5% for more than ten years. Therefore, when the retracement really comes, it will be more tragic than expected, because the market has no other emotions besides "complacency". After all, the bull market is born in despair, grows in hesitation, and perishes in excitement.