Even if the Fed raises interest rates, it will be difficult to stop US stocks from rising?

In the early hours of Thursday morning, the Federal Reserve issued a very hawkish policy statement. The main points are as follows:

1. The Federal Reserve has accelerated Taper and will end its bond purchases in March 2022. Starting from January next year, it will increase the monthly asset purchases from a reduction of US$15 billion to a reduction of US$30 billion, that is, the end of bond purchases in March 2022.

2. The bitmap further releases hawkish signals. The dot plot shows that two-thirds of officials expect to raise interest rates three times in 2022, and 60% expect to raise interest rates three more times in 2023. But it should also be pointed out that historically, the Fed's interest rate dot chart has a very poor indication effect on the actual interest rate hike path.

3. Deleting inflation is a temporary description. In the last resolution statement, "the epidemic-related supply-demand imbalance and economic resumption of work have contributed to the price increase in some industries" changed to "the epidemic-related supply and demand imbalances and economic resumption of work have continued to contribute to high inflation."

After the interest rate resolution meeting, Fed Chairman Powell stated that there will not be a long time between the end of debt reduction and the start of interest rate hikes. It is expected that full employment will be achieved in 2022, and interest rates may be raised before full employment is achieved. The meeting is expected to be held in March 2022. A signal to "consider discussing interest rate hikes" will be released, and achieving full employment may become a condition for interest rate hikes.

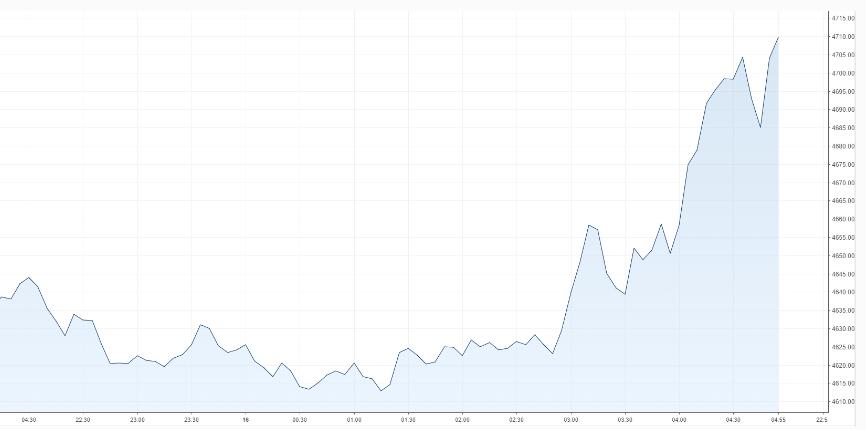

U.S. stocks rose instead of falling. This statement paved the way for the Fed to raise interest rates next year and is quite hawkish. Usually, the Fed's tightening of money will reduce market liquidity, which is not good for the stock market. But what is striking is that on Wednesday, US stocks not only did not fall but rose sharply. The US Standard & Poor's 500 Index rose 1.6% to 4,709.85 points; the Dow Jones Industrial Average rose 1.1% to 35,927.43 points; the Nasdaq Composite Index rose 2.2% to 15,565.58 points.

A Fed resolution that was interpreted by some insiders as "the most hawkish transformation", the financial market was dramatically calm, and even the risky assets represented by US stocks "played" the "strongest voice" of the interest rate discussion day. Is it true that Wall Street has completely released itself amidst the Fed’s eagles?

The market has long expected. In fact, all the Fed's statements are basically within market expectations, so the so-called "buy expectations, sell facts" has emerged. But is this situation sustainable? Although the market has digested the Fed’s tightening, the real negatives have not been eliminated, and the Fed’s early interest rate hike seems to be firmly established.

Of course, the premise is that the Fed's interest rate hike is indeed bad for U.S. stocks, but is this really the case?

In fact, let alone the Fed has not raised interest rates, even if it does raise interest rates, US stocks have risen more and fell less. Looking back at the performance of U.S. stocks after the Federal Reserve raised interest rates, you will find how normal the stock market is going to rise.

Take history as a mirror. Since 1955, there have been 13 independent interest rate hike cycles in the United States, with an average duration of less than two years. On a daily basis, the average price of the S&P 500 Index tends to record solid growth in the first year of the Fed’s interest rate hike cycle, with an average return of 7.7% after 365 days; the rate of return begins to decline 253 days after the start of the tightening cycle. It wasn't until day 452 that it broke through the previous peak again.

In other words, at least historically, many of the negative effects of interest rate hikes on the stock market may be delayed. After the start of interest rate hikes, the stock market may continue its upward trend for a period of time.

We have summarized the five recent interest rate hike cycles, and the S&P 500 index has been on the rise during all interest rate hike cycles. However, during the first one or two months of the start of the interest rate hike cycle, it was mostly in a downward trend, and then began to rise.

Although the macroeconomic conditions, inflation conditions, and employment conditions faced by the Fed in each interest rate hike cycle are not the same, the final trend of U.S. stocks is surprisingly consistent.