The Dilemma and Opportunity of Reversal of Dlocal Payment in Latin America

Dlocal (NASDAQ: DLO) is a financial technology (Fintech) company established in Uruguay in 2016. Mainly provide local/cross-border payment services, connecting global merchants with emerging markets. Since its establishment

Dlocal (NASDAQ: DLO) is a financial technology (Fintech) company established in Uruguay in 2016. Mainly provide local/cross-border payment services, connecting global merchants with emerging markets. Since its establishment, it has been developing rapidly and soon became Uruguay's first unicorn, with offices in Montevideo, Sao Paulo, San Francisco, London, Tel Aviv and Shenzhen. On June 3 this year, Dlocal went public and has a current market value of approximately US$9.5 billion.

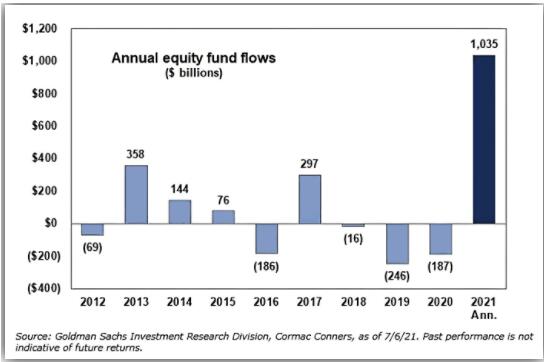

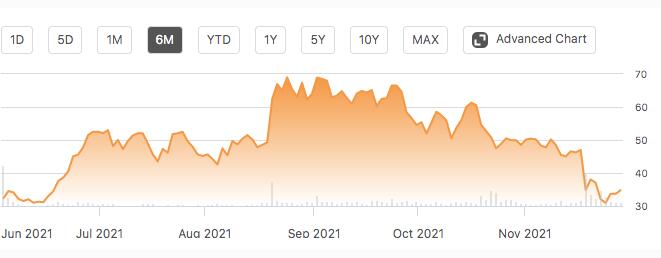

Due to the quality of the track and the better-than-expected Q2 financial report, DLO's stock price has doubled several times within a few months of listing. However, since September, continuous negatives have allowed it to get out of a unilateral downward trend, which mainly include additional issuance, lifting of the ban, and the most critical Q3 earnings report that fell short of expectations. So what is happening behind this, and how will it develop in the future, let's analyze it below.

01 Industry structure and business model

DLO mainly solves the payment problem in emerging markets, and the core is One Dlocal: a unified platform, contract and API, solve the pain points of payment, and significantly improve the operation of customers (mainly multinational giants such as Uber, Amazon, Google, Spotify, etc.) efficient. We may not feel deeply about the attractiveness of this business because there are high-quality products such as Alipay and WeChat in China, and the digitization rate is already very high.

So what does the world without DLO (mainly South America) look like? To put it simply, as shown on the left side of the picture above, multinational companies need to operate separately in different countries, facing N kinds of payment methods (about 600 kinds), tax rates, exchange rates, other policies, fraud, etc., which makes business development especially difficult.

For example, in Brazil, two-thirds of people do not have a credit card, and there are many bill-like payment methods on the market, such as Boleto. Boleto processes more than 50 million payments every month. For those without a bank card, Boleto Bancario is the only way for them to purchase online goods and services. For some people with credit cards, because they do not trust their bank information online, they will also choose Boleto for online shopping in the form of cash transactions.

Disorderly payment methods, tax rates, exchange rates, and other policy issues, as well as fraud issues, are all direct pain points for multinational companies. Where there is a pain point, it means there is a need. From the following sets of data, we can see that the market facing DLO is a blue ocean

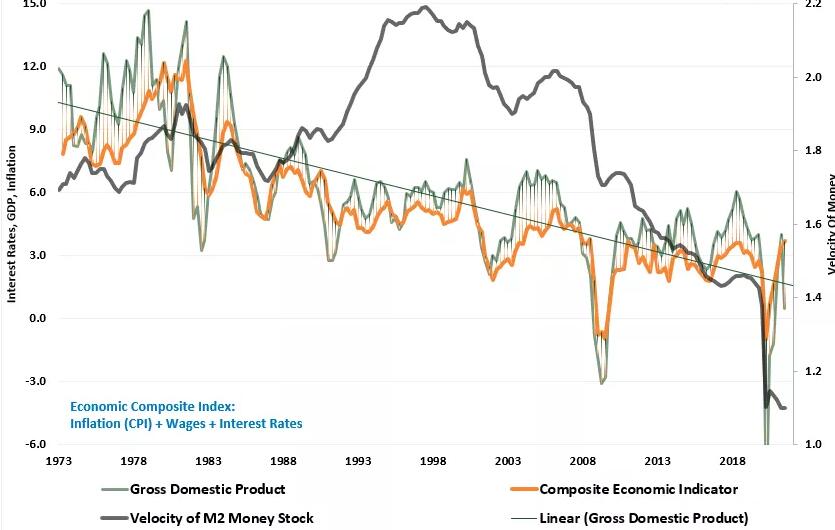

From the data point of view, there are still a large number of people without a bank card in South America in recent years. The data in Brazil in 2017 was 30%. From a global perspective, the average penetration rate of bank cards in developed countries is 69% and that in developing countries is 24%. Peace and development are the main theme of this era. Global consumption and retail have been growing steadily. In the past 15 years, the penetration rate of e-commerce has also been increasing, from 7% to 16% in 20 years. Payment is strongly related to e-commerce. This is also good for DLO. Finally, the proportion of consumption in emerging markets continues to increase, from 15% in the 1970s to about 65% today.

Under such a general trend, the giants naturally continue to increase their layout in emerging markets. As shown in the above figure, DLO’s customers’ revenue growth rate is basically 20%+, and the growth rate in overseas emerging markets is even faster. Latin America is basically a CAGR of ~30%. From the overall TAM perspective, global e-commerce is 5.5 trillion U.S. dollars, cross-border e-commerce is 2.1 trillion U.S. dollars, and the area covered by DLO is currently 59 billion U.S. dollars (the growth rate of e-commerce development in major emerging market countries is ~30%+). The penetration rate is still very low.

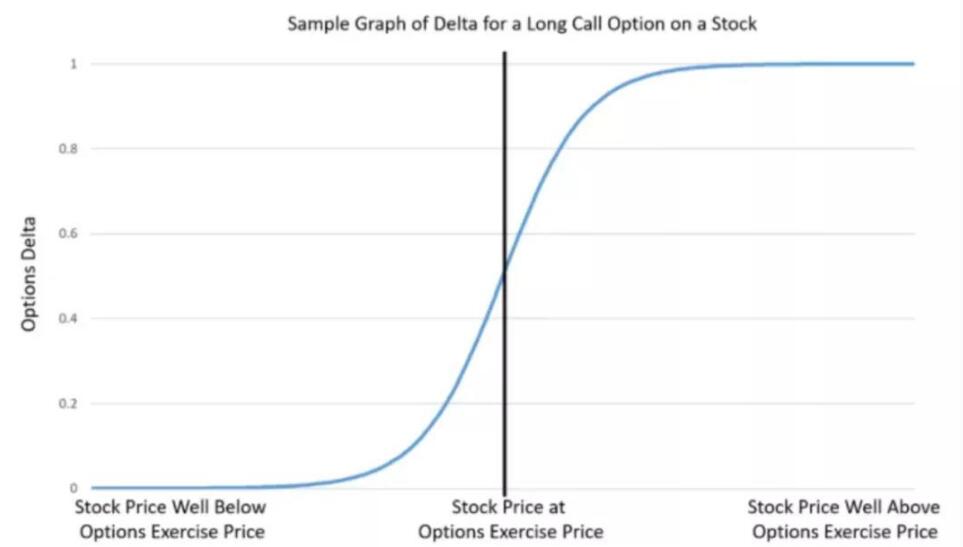

As a payment company, DLO's income sources are mainly Pay-in, Pay-out, cross-border e-commerce, and issuance of bank cards. At present, Pay-in accounts for the largest proportion and has the highest technical barriers. Specifically, Pay-in refers to the process by which end consumers transfer money to merchants. As for the technical barriers, I have explained in the previous article, because consumers will use N ways to pay, it is very troublesome to hand these payments to the merchants, and it also involves taxation, fraud and other issues. The opposite of Pay-in is Pay-out, which is the process by which companies transfer money out.

Pay-out technology content is not high, so if the proportion of this area in revenue rises too fast, it will have a significant adverse impact on the valuation of DLO, which is reflected in the decline in take rate and gross profit margin. The two indicators of DLO in the Q3 earnings report have significantly declined, but according to the management's explanation, it was caused by giving profits to the giants. The specific Pay-in and Pay-out ratios have not been announced, which will make the market less confident.

Next, look at DLO's operating conditions from the data.