Tesla's sudden fall, is it all Musk's fault?

Tesla (NASDAQ:TSLA) shares fell without surprise.

On November 7, local time, Tesla CEO Musk, the world’s richest man, launched a poll on social media asking 62.7 million fans whether he should sell 10% of Tesla’s stock (worth $21 billion, approximately 130 billion yuan). Musk also said that no matter what the result is, he will "obey the voting result."

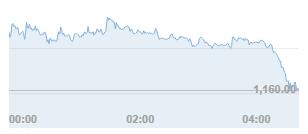

As of the end of the voting on November 8th, 3.519 million people participated, and nearly 60% of netizens voted in favor, which can make investors who hold Tesla shares panic. On Monday, before the US stock market, Tesla's stock price fell more than 7%. As of 23:40 on the 8th, Beijing time, Tesla had fallen by 3.34%, and its market value had evaporated by US$41 billion, or approximately RMB 262.3 billion.

Some analysts pointed out that Musk is facing more than $15 billion in stock option tax bills in the next few months, so regardless of the result of the vote on Twitter, he may sell Tesla stock this year. However, some people also questioned that paying taxes may be just a cover. Musk is actually looking at Tesla's recent rise, and wants to use the donkey to reduce his holdings to cash out.

Over 2 million netizens support Musk to sell stocks

Before the US stock market on November 8, Tesla's stock price fell by more than 7%. As of 23:40 on the 8th, Beijing time, Tesla had fallen by 3.34%, and its market value had evaporated by US$41 billion, or about RMB 262.3 billion.

The fuse of Tesla's share price decline is related to a vote initiated by Musk over the weekend. On November 7, local time, Musk launched a poll on social media to ask his 62.7 million fans online whether he should sell 10% of Tesla's stock.

Musk said, "Recently, many people think that unrealized gains are a tax avoidance method, so I suggest selling 10% of Tesla shares. Do you support this proposal?" Musk said that he does not receive his salary from anywhere. Or bonuses, so the only way he can pay personal taxes is to sell stocks. He also said that no matter what the result is, he will "comply with the voting result."

The latest data shows that this online voting has ended, with a total of 3.519 million people participating, of which over 57.9% of netizens expressed support for the sale. This means that more than 2.03 million netizens have supported Musk to sell 10% of Tesla's stock.

According to the data, the number of Tesla shares held by Musk is about 170.5 million shares, and based on Tesla’s share price of $1222.09 at the close of the market last Friday, the value of Musk’s sale of 10% of the shares will be close to $21 billion. (About 130 billion yuan). As a major shareholder of Tesla, if Musk is not making cheers this time, but really abiding by the voting results and proceeding to sell the stock, it will undoubtedly put Tesla's stock price under certain pressure.

Some media analysts believe that Musk's move is in response to a recent US proposal for billionaire income tax. A key point of the proposal is to impose a tax on the “unrealized gains” of assets held by about 700 billionaires in the United States, that is, to conduct annual valuations on the assets of billionaires, regardless of whether they sell assets or not. Tax on the proceeds. According to this proposal, Musk may have to pay 50 billion US dollars (about 320 billion yuan) in taxes within five years. In this regard, Musk has criticized the Democratic Party's tax proposal. He said, “In the end, the government spent other people’s money and then came to you.”

According to data from the Forbes rich list, as of the afternoon of November 8, Musk’s personal net worth was as high as 318 billion U.S. dollars, ranking first; ranked second on the list is Amazon founder Bezos, his net worth is 2030 billion US dollars.

Musk may sell Tesla stock

However, regardless of whether Musk abides by the voting results, I am afraid he will need to sell millions of Tesla shares this quarter. The reason is that he is about to receive a sky-high tax bill of more than 15 billion U.S. dollars.

As part of the compensation plan, Musk received 22.8 million stock options in 2012 with a strike price of $6.24 per share. Because he does not receive salary or cash bonuses, his wealth comes from stock awards and gains from the rise in Tesla's stock price. Last Friday, Tesla's stock price closed at $1222.09 per share, which means that his total stock earnings were close to $28 billion.

It is worth noting that these options will expire in August next year. In order to exercise these stocks, Musk must pay income tax on the proceeds. Since options are taxed as employee benefits or compensation, they will be taxed at the highest ordinary income level, which is 37% plus a net investment tax of 3.8%. In addition, Musk must also pay California's tax rate of up to 13.3%, because these options are granted during the California tax period. Therefore, plus all state and federal tax rates, Musk needs to pay 54.1% taxes on this nearly $28 billion income. Based on the current stock price, the tax payment will exceed $15 billion.

Although Musk himself has not yet acknowledged this sky-high tax bill. But he wrote on Twitter: “Because I don’t get cash wages or bonuses from anywhere. I only have stocks, so the only way I personally pay taxes is to sell stocks.”

Due to the limited time for listed company executives to sell stocks, Musk may want to control the time interval for selling stocks to two quarters. Analysts and tax experts had previously predicted that Musk would begin selling shares in the fourth quarter of 2021.

In September this year, Musk said at the Code Technology Conference: "I have a large number of options that will expire early next year, so... a lot of options need to be sold in the fourth quarter because I have to sell, otherwise they will expire. "

In fact, in addition to the 2012 salary plan, Musk is still accumulating more options. In March 2018, Tesla’s board of directors awarded him an unprecedented “CEO Performance Award”, including 101.3 million stock options (adjusted according to the 1:5 stock split in 2020), which requires Tesla’s performance to reach 12 Milestones can only be fulfilled.

Wedbush Securities analyst Dan Ives said that although a large number of shares sold by insiders is usually seen as a negative signal, sales of this scale will not have much impact on Tesla. He said that institutional investors and retail investors still have high demand for Tesla shares. The unorthodox practice of voting to gain support from fans and investors may also ease any concerns. Ives said: "Selling 10% of Tesla shares may only increase the outstanding shares by 1.5% to 2%, so this does not have much impact. I believe that this will definitely reduce the impact and will also help. To change people’s perceptions."

Gary Black, portfolio manager of The Future Fund, said that Musk’s potential stock sale will lead to “appropriate selling pressure for 1-2 days,” but he said that institutional investors will have solid demand at discounted prices. Snapped up Tesla stock.

Soaring 33 times in 29 months

Since mid-October, Tesla's stock price has accelerated. On October 25, Tesla soared 12.66%, and its market value exceeded US$1 trillion for the first time, becoming the first auto company whose market value exceeded US$1 trillion. Subsequently, Tesla’s stock price continued to rise. Last Thursday (11 April 4), Tesla’s stock price hit a record high of US$1,243.49, with a market value approaching US$1.25 trillion; last Friday (November 5), Tesla’s share price fell slightly by 0.64%, closing at US$1222.09 per share, during the year The increase was more than 73%, and the market value was US$12273 billion.

Starting from the start of a rebound in June 2019, Tesla’s stock price has risen for 29 consecutive months as of last Friday, with a cumulative increase of 33 times during the period, and a market value increase of $1.19 trillion.

The soaring performance is the biggest support for Tesla in this round of bull market. On October 21, Tesla’s financial report showed that the company set a number of records in the third quarter and achieved the best net profit, operating profit and gross margin in history.

Specifically, in the third quarter, Tesla achieved total revenue of 13.757 billion US dollars, equivalent to approximately 87.557 billion yuan, an increase of 57% year-on-year; net profit of 1.618 billion US dollars, equivalent to approximately 10.345 billion yuan, an increase of 389% year-on-year . It needs to be pointed out that Tesla has achieved profitability for 9 consecutive quarters, which has made traditional veteran car companies the envy of it. The gross profit margin of the company's auto business is as high as 30.5%, which is beyond the reach of other auto companies.

In the third quarter of this year, Tesla’s revenue in the Chinese market reached US$3.113 billion, an increase of 78.5% year-on-year. In the first three quarters, Tesla’s revenue in China was US$9.015 billion, accounting for approximately 25% of Tesla’s global revenue. , Is the second largest market for Tesla after the United States.

Recently, Hertz, one of the world’s largest car rental companies, plans to order 100,000 cars from Tesla by the end of 2022 to build its electric car rental fleet. This transaction will bring Tesla $4.2 billion. Revenue is the largest purchase of electric vehicles in history, locking in about 10% of Tesla's annual production capacity.