The stock price soared 78% in just one month. Can HTC still catch up?

Taiwanese mobile phone and tablet computer manufacturer HTC (TW:2498) (also known as HTC) announced its latest quarterly financial report on Tuesday (November 2). Due to its performance for five consecutive quarters, the company's stock price closed down 5.41% on Tuesday.

Taiwanese mobile phone and tablet computer manufacturer HTC (TW:2498) (also known as HTC) announced its latest quarterly financial report on Tuesday (November 2). Due to its performance for five consecutive quarters, the company's stock price closed down 5.41% on Tuesday.

However, according to the market data of Yingwei Caiqing Yingwei Financial Investing.com, the stock has continued to soar recently. In the past October alone, it has risen by 78%, and it has also risen by 9.91% on the previous trading day. .

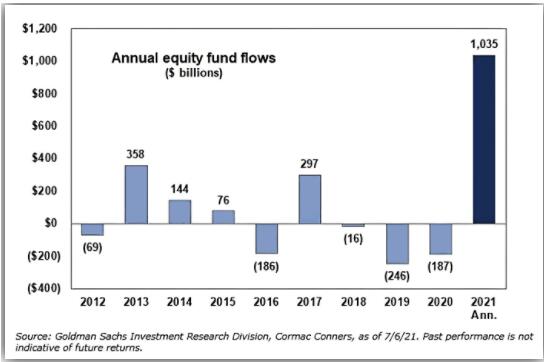

HTC’s rise is due to the recent hot “meta universe” concept. Investors have begun to pay attention to related supply chain companies. HTC is the first company to enter the VR market in Taiwan, and its stock price has naturally attracted a large influx of funds.

But how long can the concept of "meta universe" support HTC's stock price nearby? This is a question worth thinking about.

The concept of "Meta Universe" once helped Yi Hongda Electronics' performance for a short time?

Driven by cloud computing giants such as Facebook (now renamed Meta) and Microsoft, the concept of "meta universe" has attracted a lot of attention recently.

Among them, Facebook has a strong Oculus hardware team and has a high market share in integrated VR devices. As of the first quarter of this year, its market share in the VR headset market is as high as 80%.

On the other hand, Microsoft is also creating its own "Mixed Reality" MR product layout, stimulating Samsung, HP, Lenovo, Dell, and Acer to join forces with great momentum.

Looking at HTC again, the company's VIVE Flow focuses on extremely lightweight, and streamlined the connection method, with the mobile phone operation logic, so that users can carry it with them. Moreover, the company's performance has also been temporarily improved. The VIVE Focus 3 all-in-one and high-end VIVE Pro 2 products launched in the second quarter have all contributed to the performance.

However, in general, the "meta universe" is still just a concept, and it may still take 10 years to realize it. The industry still needs a long time to perfect the hardware and software ecology. Although HTC’s VR products are currently performing fairly well, there are still many uncertainties in the market outlook, and the company’s real problems are still unresolved.

The mobile phone business continues to lose money, the real problem of HTC has not been solved?

Aside from "Meta Universe", HTC's main mobile phone business is still losing money, and continued blood loss caused the company's performance this quarter to fall short of market expectations again.

According to data released by the company, in the third quarter of 2021, a single-quarter loss of 0.94 yuan per share and a cumulative loss of 2.86 yuan per share for the first three quarters, but gross profit margin rushed to an 11-year high, reaching 31.6%.

HTC’s operating income in the third quarter was 1.34 billion yuan, a quarterly decrease of 0.74%, and a year-on-year decrease of 12.4%. The operating gross profit margin rose from 29.9% in the second quarter to 31.6%, an increase of 1.7 percentage points. The gross profit margin stood at an 11-year high; The quarterly operating net loss was 880 million yuan, the operating profit ratio was -65.8%, the net loss attributable to the owners of the parent company was 770 million yuan, the after-tax loss per share was 0.94 yuan, and the cumulative loss per share for the first three quarters was 2.86 yuan.

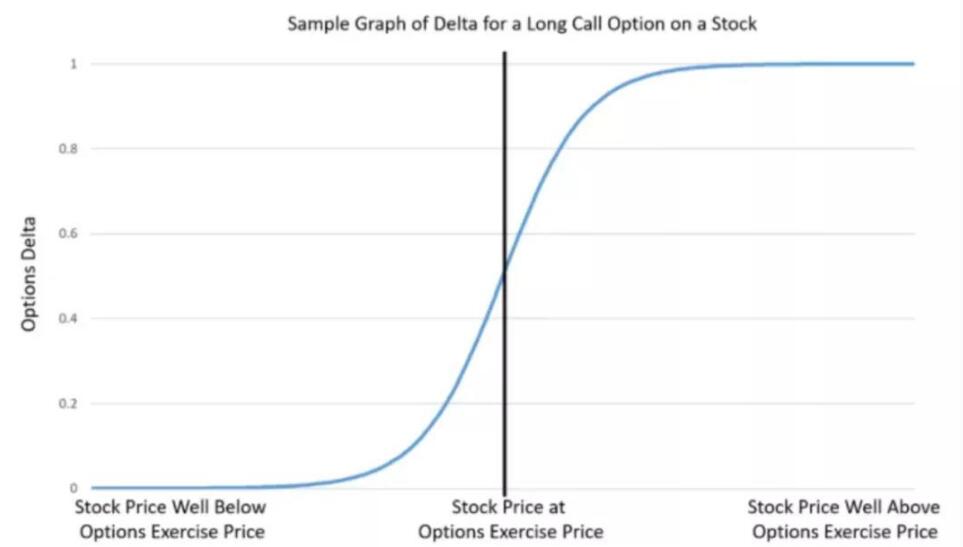

Moreover, it is worth noting that, according to recent media reports, HTC’s current institutional shareholding has been less than 10%, and the market has begun to show short-squeeze energy, and then its performance may be decoupled from the fundamentals.

In general, although the recent meta-universe concept has become a catalyst for the surge in HTC’s stock price, investors still need to be cautious about the stock with a distant concept and the mobile phone business that is still losing money.