This blue chip stock with a dividend of more than 5% is expected to take off in the near future?

To be honest, IBM (NYSE:IBM) is not a "hot chicken" on Wall Street, and unlike some other technology stocks, it can firmly attract investors' attention. Unlike other blue-chip stocks, this 109-year-old company is trying to restore performance growth and is trying to compete with other companies in an environment where it has fallen far behind.

To be honest, IBM (NYSE:IBM) is not a "hot chicken" on Wall Street, and unlike some other technology stocks, it can firmly attract investors' attention. Unlike other blue-chip stocks, this 109-year-old company is trying to restore performance growth and is trying to compete with other companies in an environment where it has fallen far behind.

According to data from Investing.com, IBM’s current market value is about US$125 billion, which is a huge difference compared with Apple’s 2.57 trillion, Microsoft’s 2.24 trillion and Amazon’s 1.7 trillion US dollars. do not.

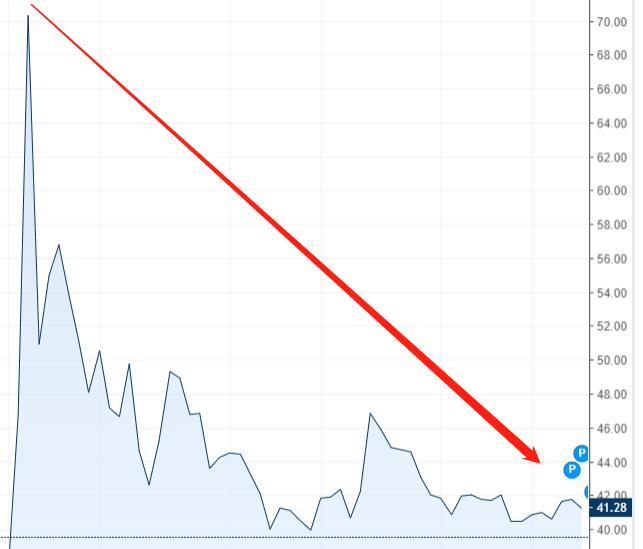

The main reason for IBM’s poor performance is that the past ten years have been the “lost ten years” of the former software and service giant, because the company failed to innovate in the rapidly changing technological world and lost to new competitors. Be left far behind-in the past ten years, due to the soaring demand for computing power and applications in the market, Amazon, Microsoft and Google have all achieved rapid development.

Investors soon discovered that during the eight years when Virginia Rometty was at the helm of IBM, the stock's performance and stock price had almost stalled. However, since she left last year, there have been signs that the "blue giant" seems to be taking off.

After years of declining revenue, IBM's new management has finally brought light to the company's long-term growth prospects.

Due to the soaring demand for cloud computing, the New York-based company announced its largest quarterly revenue growth in three years in July. In any case, IBM has risen by 10.16% this year, and the stock closed at $138.67 on Wednesday.

CEO Arvind Krishna, who took over in April last year, is currently focusing on artificial intelligence and cloud computing, seeking to revitalize IBM's growth. He has restructured the company's business around a hybrid cloud strategy that allows customers to store data on private servers and multiple public clouds. IBM completed the acquisition of Red Hat Software at a price of 33 billion U.S. dollars in 2019, which is the first step in its transformation to hybrid cloud.

Since Arvind Krishna's tenure, IBM has also made a series of acquisitions in order to accelerate growth. Including the previous acquisition of Turbonomic Inc. and the Italian process mining company myInvenio. Recently, IBM also acquired Madrid-based Bluetab Solutions Group to expand its influence in Europe and Latin America.

On the other hand, IBM is a safe dividend stock and has increased its dividend for 26 consecutive years. The stock currently has a quarterly dividend of $1.64 per share and an annual dividend yield of 4.7%, making it one of the blue chip stocks with the highest yield.

Wall Street is optimistic that IBM's stock value will be further released after the new management promotes its cloud computing business.

Morgan Stanley recently raised IBM's target price from US$152 to US$164, and said that due to improved execution and increased demand, IBM is on the right track. The investment bank wrote in the report: "Higher quality revenue, improved macro trends, and the company's important investment in talent, partners, and market inputs have all strengthened our confidence in the acceleration of growth in 2022."

Credit Suisse also pointed out in the report that IBM's strong second-quarter results helped to push the stock back on its upward track. "We believe that the possible spin-off of Kyndryl in the fourth quarter is a key catalyst that will clear the way for IBM's continued growth and support multiple expansions in the future."

Overall, the growth of IBM in the past decade has indeed disappointed investors. But after the company's successful acquisition of Red Hat and new management in place, we see that the company is slowly returning to the path of growth. IBM's healthy balance sheet, manageable debt and a dividend yield of more than 5% make its stock worthy of investors' further attention.