U.S. stocks are about to start "bumps", how does Wall Street hedge the risks?

The market in September is like "Schrödinger's Cat". You won't know whether this "cat" is alive or dead until you open the box. In the market, there are two kinds of voices. Optimists believe that US stocks are "unstoppable", and pessimists believe that US stocks will collapse at any time.

But we are more inclined to believe that even if the overall market does not experience a sharp correction of more than 10%, the volatility of US stocks will gradually increase in the coming trading days of this year. In our previous article, we suggested that investors “sit down and wear your seat belts”. In the US stock market where the risk of callbacks is increasing, “precautions against risks are very important, and some risk hedging methods can be appropriately adopted. ."

In fact, in the stalls where the U.S. stock market has just set a record of 12 closings, on the one hand, the footprint of speculative retail investors is declining. Robinhood’s retail investors’ current share of derivatives trading volume has fallen to the lowest level since April 2020. And the demand for short-term call options from large technology companies that retail investors love is cooling. On the other hand, Wall Street traders are intensively carrying out risk hedging arrangements.

Dave Nadig, chief investment officer of ETF Trends, said in an interview with the media earlier this week, "Wall Street analysts all feel that the market seems to be at a certain tipping point. Some things are overvalued. There are no more catalysts. Under the circumstances, it may be “melted”, which is why you have to hedge.” He pointed out that equity funds are currently using option coverage to hedge against the risk of market downturns. “The market does reach a certain extreme volatility. At that time, it will be a kind of insurance."

Asset management agency Simplify CEO Paul Kim also said that the largest ETF under the agency, Simplify U.S. Equity PLUS Downside Convexity ETF (SPD), currently holds about 3% of put options to prevent extreme downturns in the market. The iShares Core S&P 500 ETF (NYSE: IVV) and its other fund, US Equity PLUS Convexity ETF (SPYC), also have similar hedging measures. “You only need to spend a little money, but you can get one Bigger protection. You can think of it as disaster insurance."

He also pointed out that “in the current environment where bonds are difficult to achieve portfolio diversification, the use of options for direct hedging is very effective.”

At the same time, under the influence of the MEME stock boom at the beginning of the year, Wall Street's short-selling transactions were once very sluggish, but it seems that they have become active again recently, and people have once again ignited confidence in the performance of hedge funds in 2021.

AXS Investments CEO Greg Bassuk pointed out that after the stock market has soared to record levels, investors are turning to other assets for sustained returns. The hedge fund provides downside protection against the COVID-19 pandemic and Fed Taper risks.

Hedge funds have a very difficult start this year. The terrible squeeze of individual stocks such as Game Station has caused great pain to the shorts, and they have been forced to liquidate their positions to reduce their risks. However, now hedge funds are showing signs of a "come back". According to Morgan Stanley's data, in July, hedge funds' short positions had the best alpha value since 2010, and they are currently outperforming long positions.

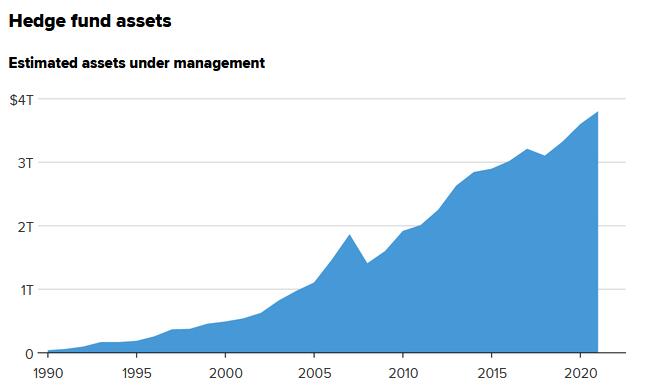

At the same time, according to HFR data, after three consecutive years of fund outflows, customer inflows exceeded US$6 billion in the first quarter, pushing the industry’s total assets under management to a record US$3.8 trillion. However, according to HFR data, as of the end of July, hedge funds have risen by 9.2% so far in 2021, which is still significantly behind the market's 17%.

On the other hand, the buying trend of US Treasury bonds also shows the determination of investors to hedge.

The yield, which is the opposite of the bond price trend, has continued to fall after rising from January to March, and has fallen by about 25.6% since April. Although there have been voices on Wall Street before that, as inflation in the United States has soared and the economic outlook is sound, the yield will definitely rise, but the overall demand for US Treasury bonds remains high.

According to market data, the benchmark U.S. 10-year Treasury bond is currently yielding 1.297%, well below the March high of 1.749%.

Some analysts pointed out that US Treasury bond yields can both affect and reflect economic prospects. When COVID-19 cases begin to decline, yields may rise, but the recent rebound in delta-related cases has suppressed investor sentiment and prompted them to look for safer assets.