Wall Street has been taking the wrong direction recently? U.S. bond yields may continue to fall

U.S. Treasury yields continued their decline on Monday to a five-month low. Because of the new wave of pandemic concerns under the Delta virus, risky assets are under pressure, and investors have turned to hedging in bonds.

U.S. Treasury yields continued their decline on Monday to a five-month low. Because of the new wave of pandemic concerns under the Delta virus, risky assets are under pressure, and investors have turned to hedging in bonds.

US long-term Treasury bonds and other developed market bond yields have fallen sharply. Among them, the U.S. 10-year Treasury yield fell 12.2 basis points to 1.177%; the U.S. 30-year Treasury yield fell 11.8 basis points. To 1.812%.

The surge in the price of US long-term Treasury bonds (the prices and yields are the opposite) can not be said to have really scared the market. Because the market had expected that the economy would continue to recover and re-inflation transactions would return to the right track, Wall Street investors have been increasing their bearish bets on longer-term Treasury bonds. In the magical market, what is the trend of the U.S. Treasury market outlook?

Has the re-inflation trading logic in the U.S. bond market given way?

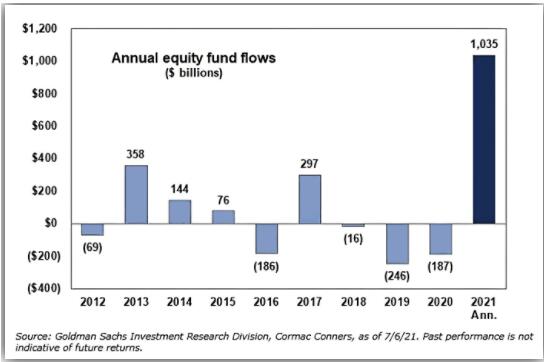

Many investors on Wall Street have been betting on the wrong direction recently. According to data from the US Commodity Futures Trading Commission (CFTC), the total net short positions of leveraged funds in 20-year and 30-year US Treasury futures reached the highest level since February last week (the week of July 12).

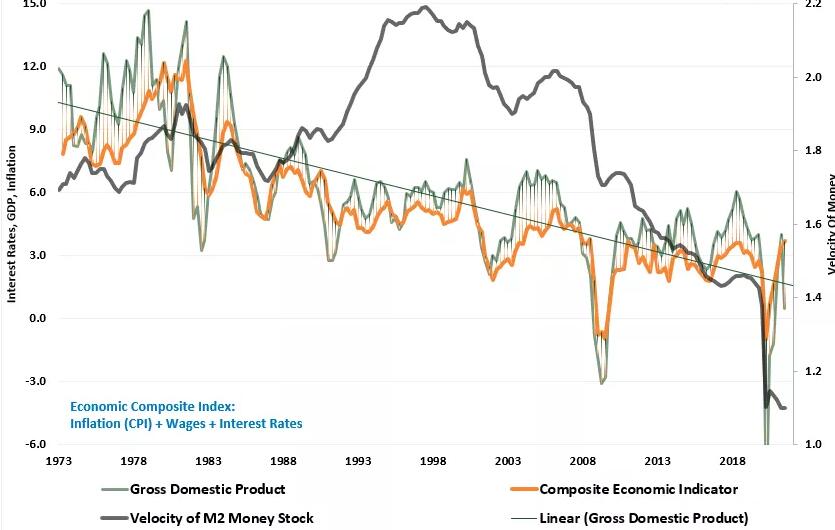

With the soaring growth expectations and increasing inflation concerns, the benchmark 10-year U.S. Treasury bond began a downward trend after it fell to around 1.8% in March and has been falling for several months. Until Monday, it fell below 1.20% for the first time since mid-February. Because the market expects that the economy will restart growth, inflation will rise sharply.

Analysts at KBC Bank also wrote in a report that the uncertain outlook of the new crown epidemic has led to a cautious market sentiment, and core bonds are also being sought after at this time. But from a technical point of view, the 10-year U.S. Treasury has fallen below 1.25%, further hinting at the prospect of re-inflation trading.

Generally speaking, high inflation should cause bond yields to rise because it reduces the value of interest payments and may cause the Federal Reserve to raise short-term interest rates. However, under the current circumstances, many investors believe that consumer price increases are caused by one-off factors related to the economic restart, and market-based long-term inflation expectations have declined in recent months. The 10-year TIPS break-even inflation rate was reported at 2.257%, suggesting that the market expects the average annual inflation rate for the next 10 years to be slightly lower than 2.3%.

However, Gang Hu, the managing partner of WinShore Capital Partners, pointed out that the current re-inflation trading in the bond market has given way to a completely different trading logic, that is, investors are beginning to consider the possible slowdown of the US economic growth and inflation. The prospect of long-term higher data. He believes that investors who continue to sell stocks and commodities and buy long-term treasury bonds for hedging behavior may reduce the 10-year treasury bond yield to 1% in the next two months.

Gang Hu bluntly said, "The loosening of inflation expectations is happening, which puts the Fed in a more difficult position. The Fed’s job is to control the wage-price spiral before inflation gets out of control. If it fails to do so, the fundamentals will It will soon disintegrate. Therefore, if the Fed wants to contain risks, it needs to turn to the Eagle."

Darrell Delamaide, an exclusive analyst at Investing.com, pointed out earlier in the article that more and more evidence shows that Powell's assertion that inflation is temporary is becoming increasingly untenable. As the base effect of the price slump a year ago faded, inflation should have subsided, and the supply shortage that lasted for several months only temporarily avoided the problem.

Delta virus lingers, concerns about stagflation appear?

All along, people may think that concerns about stagflation are premature. However, the performance of the overnight market does not seem to agree. Some investors believe that the decline in yield reflects the weakening of inflation concerns, and investors have lowered their premium expectations in order to protect future coupon rates from the erosion of inflation. However, some people believe that the yield and Monday's fall in US stocks indicate people's concerns about stagflation.

US applied economics expert Steve Hanke said on Monday that it is expected that US inflation will climb to 6-9% by the end of the year, and this will make the US economy once again experience the highest consumer price growth since the 1970s. In the 1970s, the United States experienced an economic phenomenon known as stagflation, low growth and high inflation. We will slowly return to the stagflation era of the 1970s. "

At the same time, with the Delta variant virus, the fragile economic restart becomes uncertain again. On Monday, more analysis pointed the culprit of Monday’s plunge to the Delta variant virus, which is currently causing a new round of epidemic crisis in various countries around the world, including the United States, the United Kingdom and other countries where vaccination is already common. People worry that this highly contagious mutant virus may spread further, putting pressure on economic recovery.

Moreover, the epidemic does not seem to be the only cause. State Street Bank’s senior global market strategist Marvin Loh pointed out that Washington’s additional fiscal stimulus has been stagnant for some time. In addition, although the Fed has made it clear that the bank will not rush to reduce the scale of bond purchases or raise interest rates, the reduction of monetary stimulus measures is a foregone conclusion. Major central banks in the world, including the European Central Bank and the Bank of Canada, have begun to consider reducing stimulus measures.

Marvin Loh, senior global market strategist at State Street Bank, said on Monday, “The U.S. interest rate market has in fact been sending signals of growth concerns over the past few months.” Dan Creter, strategist at Bank of Montreal (BMO) in Canada It is also believed that: "The continued spread of Delta has increased the uncertainty of economic growth and inflation prospects."

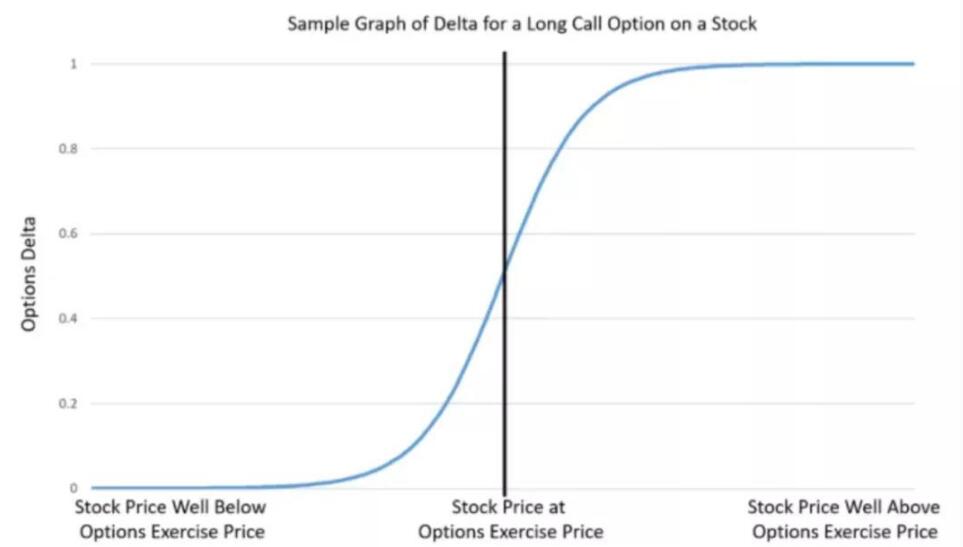

At the same time, Tony Rodriguez, head of fixed income strategy at Nuveen, also said that people are worried about the economic outlook. There is still more demand for hedging in the market. Moreover, the violent decline in U.S. Treasury yields will trigger stop-loss orders. As the 10-year nominal interest rate breaks through the 1.21%-1.22% range, many hedge funds on Wall Street will be forced to stop losses, leading to further declines in yields. To about 1.05%.