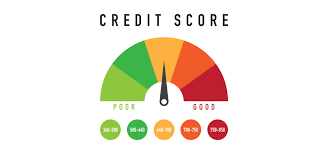

Want to Improve Your Credit Score? These Details You Need to Pay Attention to

No matter where you go in the States, you can't do without your credit score. A good personal credit reports makes it easy to do anything and banks will undo many onerous restrictions due to your excellent credit report. Sometimes we have done everything required, and there is no late payment, credit score is still not ideal, why? Today, I will lead you to dig into a few deep reasons that are not easy to discover.

Payment plans

If you want the latest iPhone or another new mobile phone, sign a contract with the phone company and open payment plans over the phone, these transactions are generally classified as installation loans. Although the monthly payment is very low, it will still be included in the Credit Subsystem. If you want to keep good credit, you need to make sure you pay on time every month.

Credit limit

When we find that the credit card limit is not enough, there is a solution to call the bank to increase the limit. But please note that at this point the bank is likely to give you a hard blow on your credit report, the credit score will be reduced by a few points in an instant. Some card issuers or banks will have a soft pull policy, which will not affect the credit score. There is also a bank that automatically increases your credit limit, which will not affect the credit score.

Medical bills

As we all know, the length of credit history is the most critical indicator for measuring credit rating. Any medical bill that is not paid on time can be sent to collection agencies, which will seriously damage your credit score and will be published on public records. This file can sometimes last up to 7 to 10 years. Even if you have already paid the invoice, you cannot delete the registration. In order to avoid such incidents, you must provide correct medical insurance information when requesting medical treatment and promptly check with the hospital if your medical bills are due.

Utilities and rente

If these invoices are not paid in a timely manner, it is likely that there will be associated late fees. If it has not been paid within a certain period of time, it will be reported to your credit history. Taking the example of the rental, the landlord will likely not mention your payment history, but will certainly report your non-payment records. If you do not respect the housing contract, you will also be informed of the termination fees.

Parking tickets

Almost all fines that are not delivered on time will seriously affect credit history, and even affect job application or welfare. Of these, illegal parking tickets are often not taken seriously due to the low fines, but in most cases they will always be sent to your credit bureaus, which will have a negative impact on the credit.

Library books

Does this also affect credit score? It may sound a little incredible, but the facts affect it. If you don't return the book on time and don't pay the overdue fine, the library will most likely notify the credit bureaus. Such behavior is also classified as dishonest performance, which will have a negative impact on the credit rating.

Co-signing

Sometimes your family or friends are in urgent need of a bank loan, but because the credit score does not meet the requirements and cannot be successful. If you want to help each other, you can guarantee them as a co-signer. At this point, your credit score can be affected in three ways:

• New loans may affect the interest rate on existing loans because the overall risk has changed

• New loans will also appear in your credit report

• If a friend or family member fails to repay on time, the same will be reflected in your credit report

Car lease

In recent years, car dealers have provided a new way to meet the needs of young consumers who frequently change cars - The lease should note that when signing a car rental agreement, these costs always appear to our credit in the form of car loans On file. When the total amount of the loan exceeds a certain percentage, this will have a negative impact on the crediting households.

Conclusion

In order to prevent these things from unintentionally affecting our credit, we must first understand it sufficiently, the best way to solve the problems is to avoid the problems. For example, we know that the co-signer's credit rating is not high. Before choosing to provide aid, we must first determine whether we have the capacity to bear this risk. I hope my friends' credit scores will reach 800 as soon as possible.